Global stocks continued their ascent this summer from the depths of the April “tariff tantrum” lows. The S&P 500 posted an 8.12% gain through the third quarter, and the MSCI Europe, Asia, and Far East Index climbed by 4.83% (yCharts). Bonds, as measured by the Bloomberg U.S. Aggregate Index, also rose by 2.03% following a lackluster performance during the second quarter. Strong corporate earnings, de-escalation of the summer conflict between Iran and Israel, and the passage of Trump’s One Big Beautiful Bill Act (OBBBA) helped inspire economic and investor confidence. The Federal Reserve, which has once again begun cutting interest rates, also helped bolster stock and bond performance.

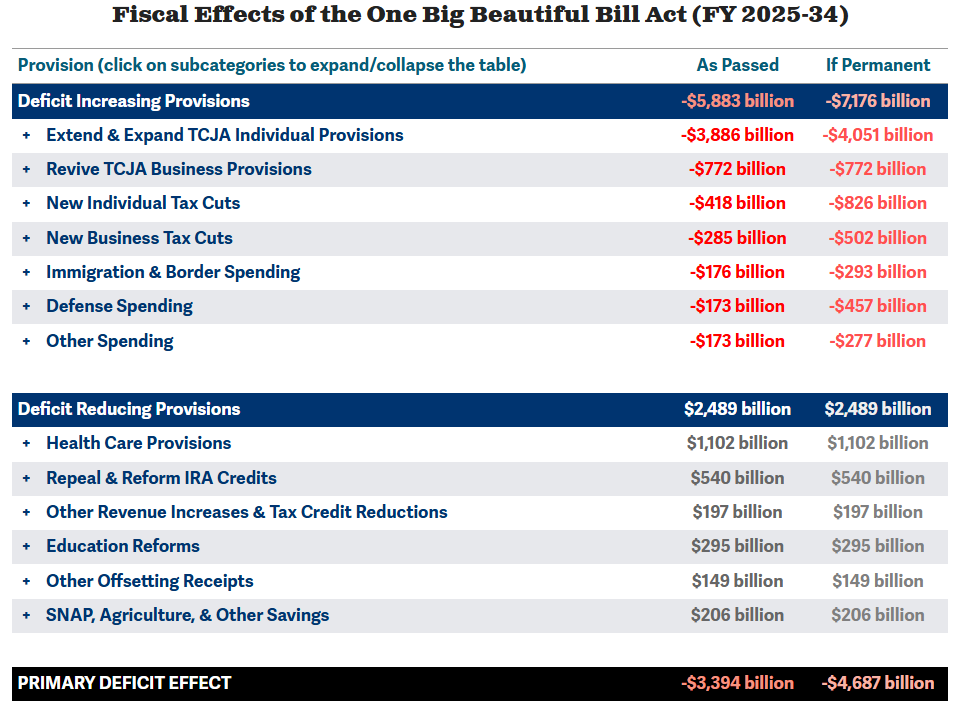

These policies may well give us a relatively new economic environment in 2026—one where both changes in monetary (Federal Reserve) and fiscal (government spending) policy are stimulative. Debt-funded fiscal stimulus will be especially potent, with the Congressional Budget Office estimating that the OBBBA will increase the federal deficit by $3.4 trillion through 2034. These figures could potentially be even higher if certain temporary tax provisions are made permanent (e.g., keeping the increased State & Local Tax Deduction [SALT] cap beyond 2029).

Stimulus should help spur near-term economic growth, although higher debt burdens and interest costs can weigh on an economy over the long-term. Regardless, we anticipate accommodative fiscal and monetary policy becoming an increasingly strong tailwind for economic growth and stock market performance through year-end and 2026.

After a Nine-Month Pause, Rate Cuts Resume

The fiscal stimulus from the OBBBA was accompanied by the first interest rate cut from the Federal Reserve since December 2024. Its decision, which was delivered on September 17, was accompanied by guidance suggesting an additional two cuts through year end, placing the Federal Funds Rate 0.75% lower than it was through August of this year. Jerome Powell, who chairs the Federal Reserve, cited slack in the labor market and, specifically, the lack of recent job creation as a primary motivator for the cut:

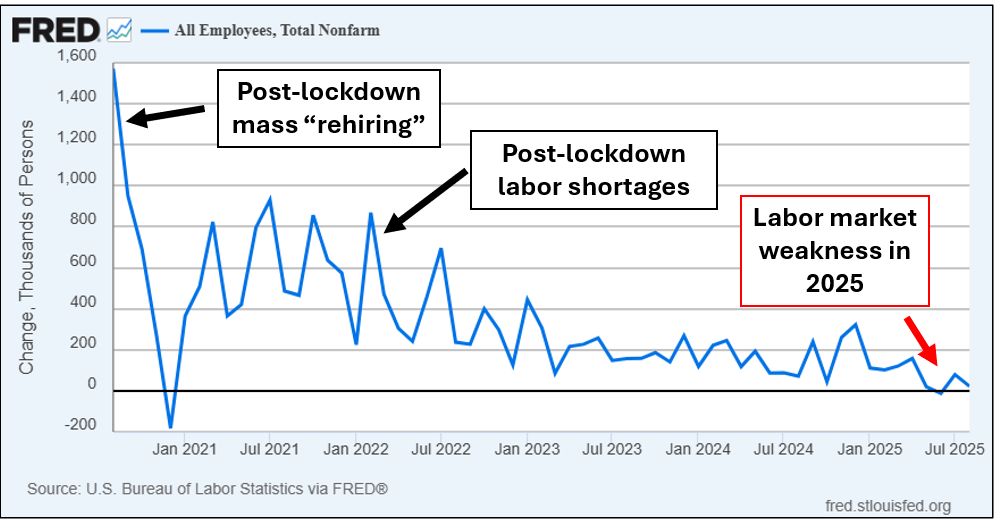

“Labor demand has softened, and the recent pace of job creation appears to be running below the break-even rate needed to hold the unemployment rate constant.”

Over the summer, the lack of job creation became especially apparent when the Bureau of Labor Statistics not only reported relatively few jobs added in July but also downwardly revised previous jobs data for May and June. The net effect of the revisions was that 258,000 fewer jobs were added to the economy than originally estimated. In September, another report downwardly revised the estimate of jobs created between April 2024 and March 2025 by 911,000. Job openings have declined as well, now hovering around pre-pandemic levels. Below is a chart displaying the monthly number of jobs added in the U.S., according to the Bureau of Labor Statistics.

Falling job creation is less than ideal, but neither we nor the Fed are currently sounding the alarm on recession risk. Why? There is very little layoff activity and certainly not the kind of job losses associated with economic contractions. Data shows that the number of people filing for unemployment benefits for the first time (a measure of recent job losses) remains near multi-year lows. Similarly, the number of announcements of mass layoffs hasn’t materially increased versus recent years.

The Federal Reserve hopes that rate cuts will help stimulate hiring, business expansion, and consumer spending. And it’s true that lower interest rates decrease the overall cost of capital, making businesses generally more profitable and big-ticket items easier to finance (e.g., mortgages, equipment loans). Investors know this, which is why stocks have climbed, despite labor market weakness, ever since Powell first hinted at the possibility rate cuts in mid-August.

Lower rates can help spur economic growth, but they still don’t address the “elephant in the room” weighing on many businesses—tariffs and ongoing policy uncertainty.

Are the Tariffs Still an Economic Threat?

Many businesses are struggling to adapt to tariff and trade policy in 2025. Exacerbating overall business anxiety is the fact that policy is in a frequent state of flux and changes from week to week. Manufacturers are especially under pressure, with the Institute of Supply Chain Management (ISM) survey indicating that the sector has been in contraction for six consecutive months. A few notable quotes from the August ISM report include the following:

- “‘Made in the USA’ has become even more difficult due to tariffs on many components. Total price increases so far: 24 percent; that will only offset tariffs.” (Electrical Equipment)

- “The trucking industry continues to contract. Our backlog continues to shrink as customers continue to hold off on buying new equipment…. This is 100 percent attributable to current tariff policy and the uncertainty it has created.” (Transportation)

- “Orders across most product lines have decreased. Financial expectations for the rest of 2025 have been reduced. Too much uncertainty for us and our customers regarding tariffs and the U.S./global economy.” (Chemical Products)

On the bright side, manufacturing represents only about 9.4% of Gross Domestic Product (GDP), and the services side of the economy is in better shape. Still, there is significant overall stress surrounding trade policy, and many businesses are having trouble planning around it. The sooner that finite and final trade policy is put into place, the better it should be for businesses, the labor market, and the economy as a whole.

Side Note: Who’s Been Paying the Tariff “Tax?”

Our April commentary included a lengthy discussion on Trump’s new (at the time) tariff policies, including our opinion that tariffs can be viewed broadly as a tax. Whether from actual import duties or expenses due to onshoring production, the ultimate cost of tariffs falls on companies and/or their customers. Businesses seek to maximize profits and generally prefer to push costs onto consumers, but various factors such as demand elasticities, competition, and availability of substitute products may limit their ability to do so.

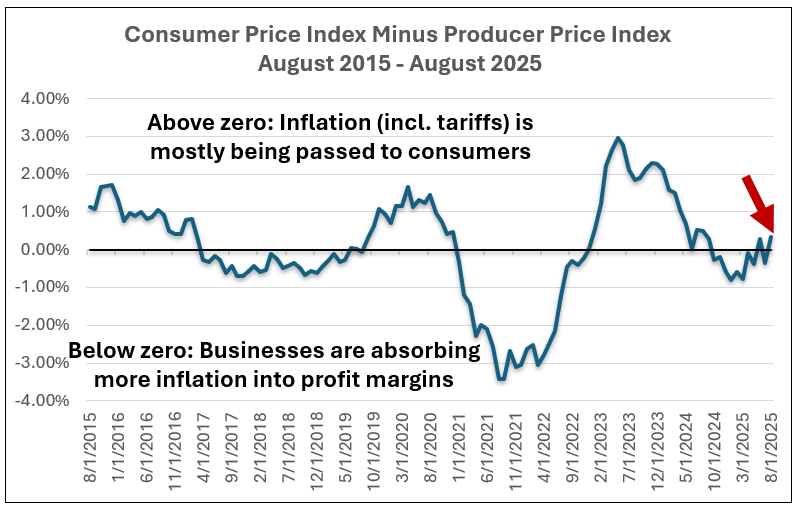

Who’s paying for tariffs in 2025? Although it varies from firm to firm, we can create a rough estimate by comparing changes in the Consumer Price Index (CPI) versus the Producer Price Index (PPI). The CPI tracks the cost of finished goods and services for consumers, while the PPI tracks inflation for business at all parts of the supply chain. Comparing CPI versus PPI can indicate whether tariff costs are being passed onto consumers or absorbed by corporate profit margins.

The above chart shows that tariff costs were initially absorbed primarily by businesses at the start of this year but that the pendulum has swung, and those costs are now increasingly being passed onto consumers. Even so, the disparity between consumer and producer inflation is a far cry from the COVID recovery through the initial years of the Russian invasion of Ukraine. At the time, producers absorbed initial inflation spikes in 2021 and early 2022 but successfully passed higher prices onto consumers from then through mid-2024. Although surprising to consider, consumers and businesses seem to be “sharing” the burden of inflation more equitably in 2025 than in the prior years of the 2020s.

Year-End Forecast – Expecting Green & Taking Advantage of Tactical Opportunities

Lower interest rates and tax cuts from the OBBBA should be supportive for both stock and bond performance in Q4. Strong corporate earnings are also a tailwind for stocks. Labor market weakness isn’t ideal, but the lack of job losses and layoffs remains muted, substantially decreasing economic risk. Our optimism not only applies to domestic markets, but international stocks (especially European and emerging market equities) as well.

In conclusion, the weight of evidence supports a strong close for markets to another strong year. On behalf of WELLth Financial Planning, we wish you a happy, healthy, and prosperous fall and holiday season.

Christopher Diodato founded WELLth Financial Planning in 2020 to help individuals live their best financial lives through expert, conflict-free guidance. He carries a rare combination of credentials — the CFA, CMT, and CFP charters — allowing him to create and implement best-in-class investment and financial planning strategies. A passionate advocate of the FIRE movement, Chris helps clients design life plans that reflect their unique vision of financial success, whether that means early retirement or more time for what matters most.