Asset “location,” or managing one’s investments within the context of how different types of investments are taxed, is a fairly simple and underutilized strategy to lower your tax bill. The reason why asset location exists is because different types of investments are taxed differently.

For instance:

- Long-term stock investments are taxed at favorable capital gains tax rates

- Short-term stock investments are taxed at unfavorable ordinary income tax rates

- Dividends are mostly taxed at favorable tax rates

- Real estate investments (house flipping) can be taxed at favorable rates

- Bond and savings account interest is taxed at unfavorable ordinary income tax rates

- Rental income is taxed at unfavorable ordinary income tax rates

- Commodity futures are taxed partially at favorable capital gains tax rates

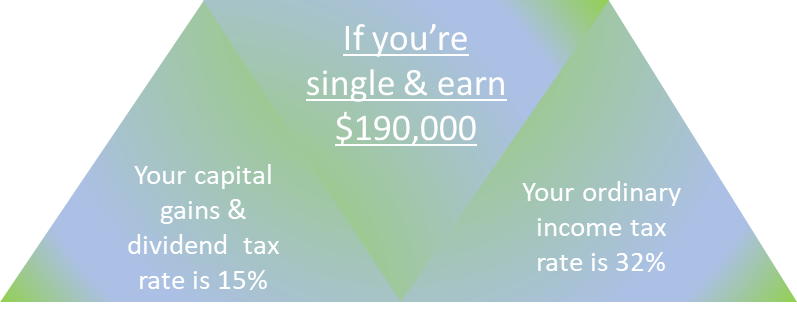

The spread between these favorable capital gains and dividend rates versus unfavorable ordinary income tax rates is often significant. Below are a few examples:

Or looking at it another way, imagine you make $190,000 a year and you own $100,000 of a specific stock and a $100,000 of a bond. Both neither increase or decrease in value, but the stock pays you $5,000 in dividends and the bond pays you $5,000 in interest each year.

After taxes are paid, the stock will leave you with $8,500 more in your pocket after ten years and $17,000 after twenty years.

This dilemma outlined above actually occurs quite often as investors decide whether to purchase certain high-yield bonds or preferred stocks. For the tax reasons mentioned, preferred stocks tend to often be the more favored investment option.

Enter Asset Location

If you made it this far, all you need to understand is that some investments are taxed more favorably than others. Unfortunately, tax-inefficient investments such as bonds are an essential component of a diversified portfolio, meaning you need to own them somewhere. Asset location theory suggests that “somewhere” should be in a tax-advantaged account, such as a 401k, IRA, or Roth IRA. That way, when your tax-inefficient investments are spitting out taxable income, it won’t be taxed.

An Asset Location Example with Two Accounts

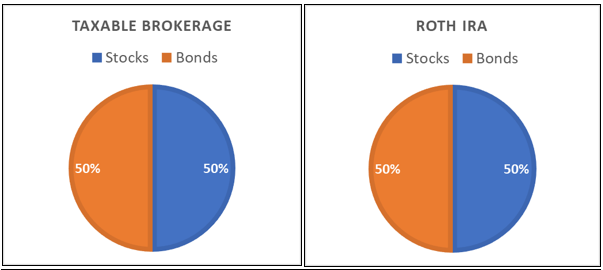

Let’s take a client who, based on their investment goals, should have a portfolio composed of half stocks and half bonds. They have a $500,000 taxable brokerage account and a $500,000 tax-advantaged Roth IRA. Without using asset allocation, both accounts would be allocated as follows:

No Asset Location

In this portfolio, the interest from the bonds allocated to the taxable brokerage account would be taxed at higher, unfavorable tax rates while the interest in the Roth IRA would be tax-free. So why not put all of the bonds in the Roth IRA and all of the stocks in the taxable brokerage account? That’s asset location.

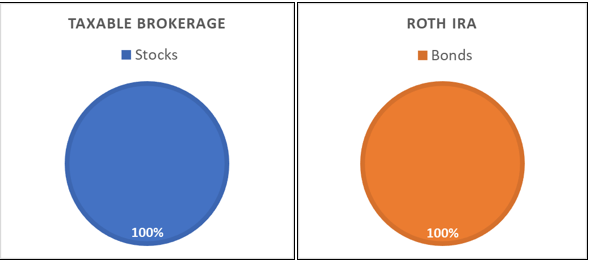

With Asset Location

In this strategy, if the bonds are paying 5% in interest a year and the stocks are also paying 5% in dividends per year, this client would hypothetically save $2125 each year in taxes. Things to note:

- Asset location did not increase the portfolio’s risk

- It did not affect overall pre-tax portfolio return

- Actively trading the stocks in the taxable brokerage account will reduce the effectiveness of this strategy

Final Thoughts

This is legal tax avoidance. It is not frowned upon by regulators nor is the tax code opaque regarding the taxation of interest versus dividends. If you have a taxable investment account and a tax-deferred or tax-free account, consider discussing with your advisor the merits of deploying an asset location strategy. If you don’t and wish to work with one, we would love to meet you. You schedule a complimentary 1 hour call with us here to discuss anything you would like!